India's first

fully cashless

healthcare experience

Get top-tier group health insurance with a seamless cashless claims experience for your team and families.

60,000+

Lives Covered

250+

Companies

3k+

Fully Cashless Claims

4.9/5

App Rating

Group Health

Insurance

Keep your team healthy and thriving with reliable coverage

Group Personal

Accident Insurance

Safeguard your employees from life's unexpected twists

Group Term Life

Insurance

Provide peace of mind with secure life coverage for your team

Super Top-Up

Insurance

Amplify protection for major medical expenses

Never Pay Out-of-Pocket

100% Cashless Claims

We are redefining claims experience across all hospitals

Nationwide Coverage

Enjoy world-class healthcare, without out-of-pocket costs

Zero Paperwork

We do all the paperwork, so you don't have to

Human Process

A high-touch human process for fast and empathetic healthcare

Partnering with leading hospitals in India

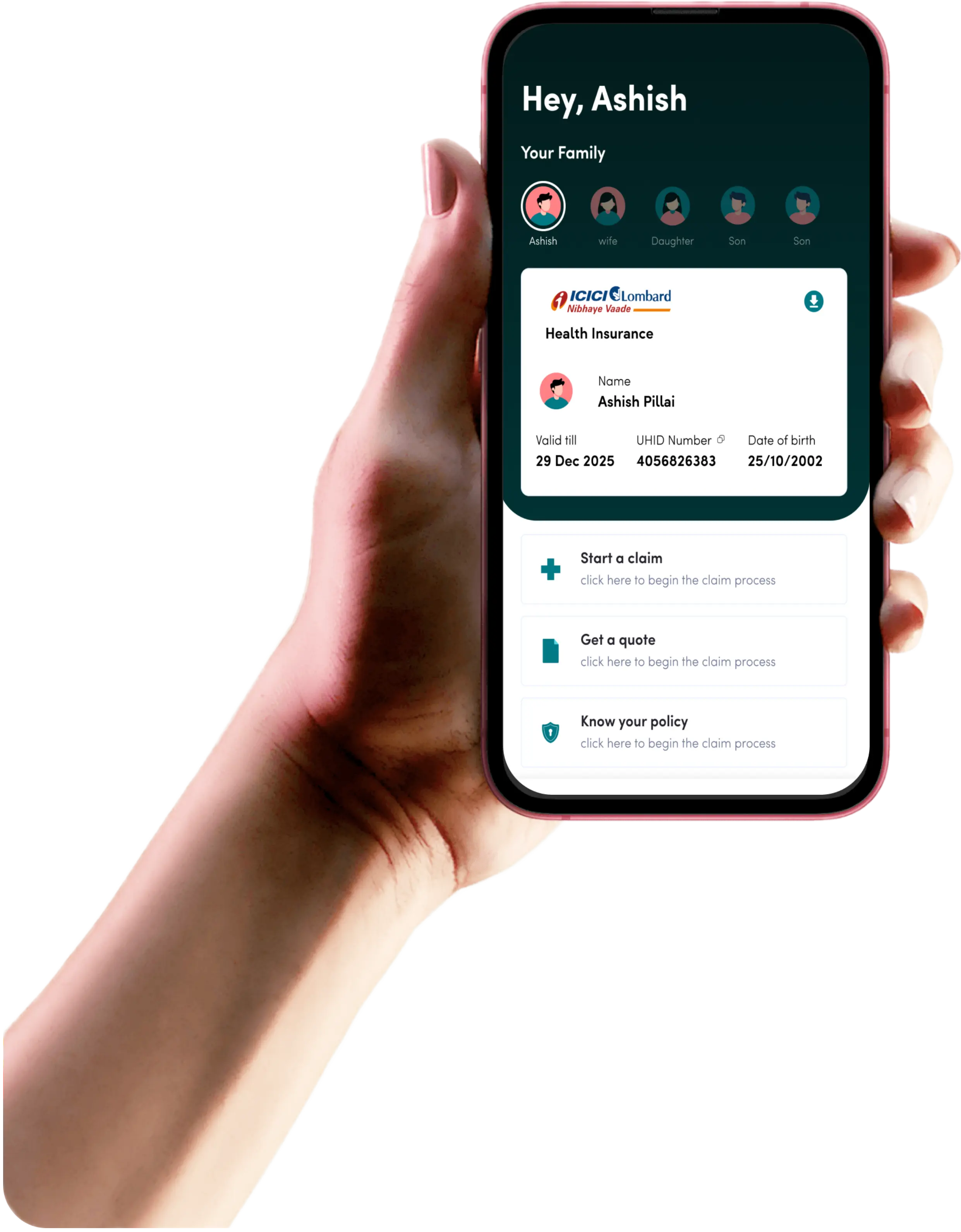

Healthcare in Your Pocket

Manage your policy, treatments, claims, and dues instantly on our app.

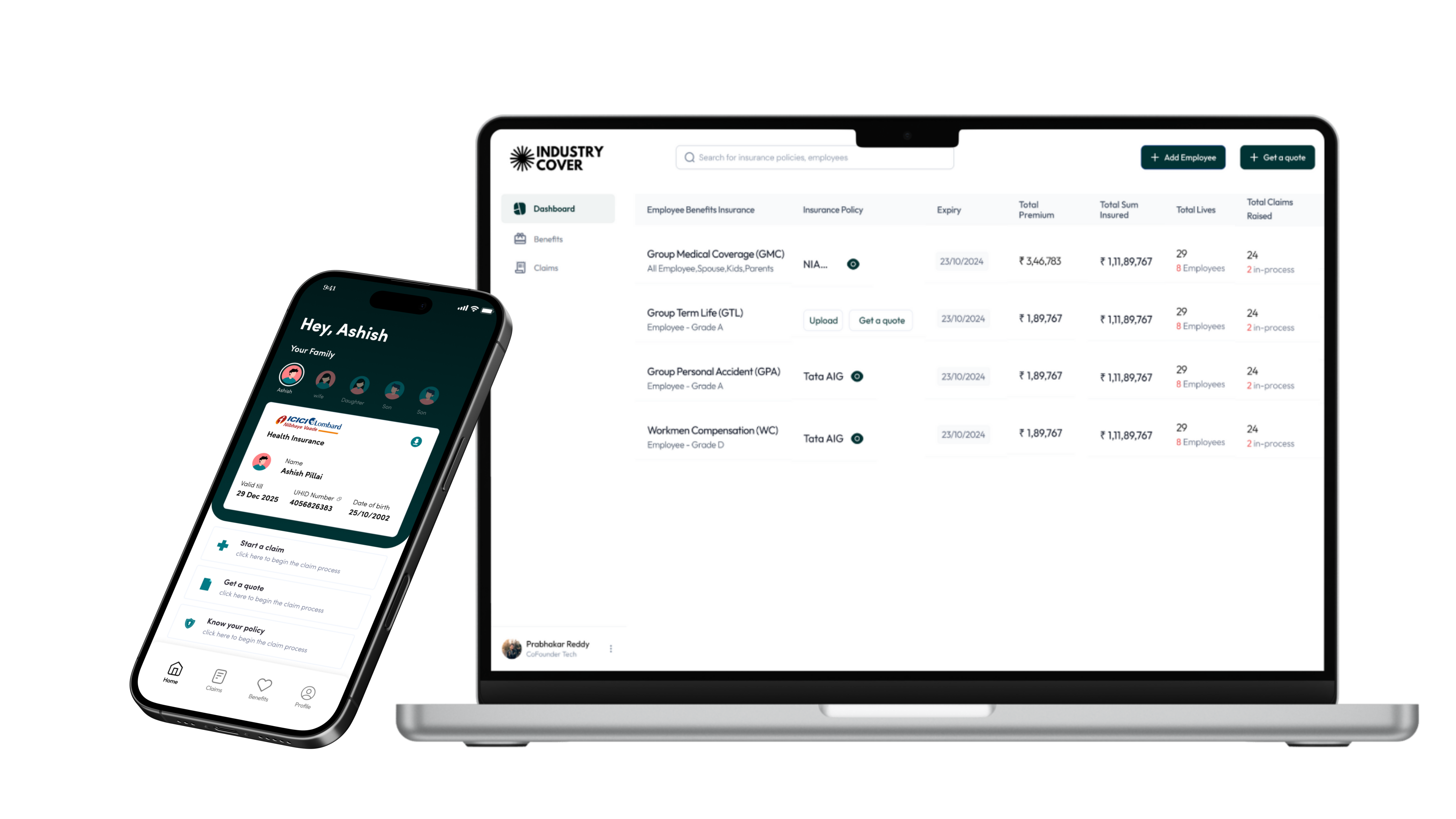

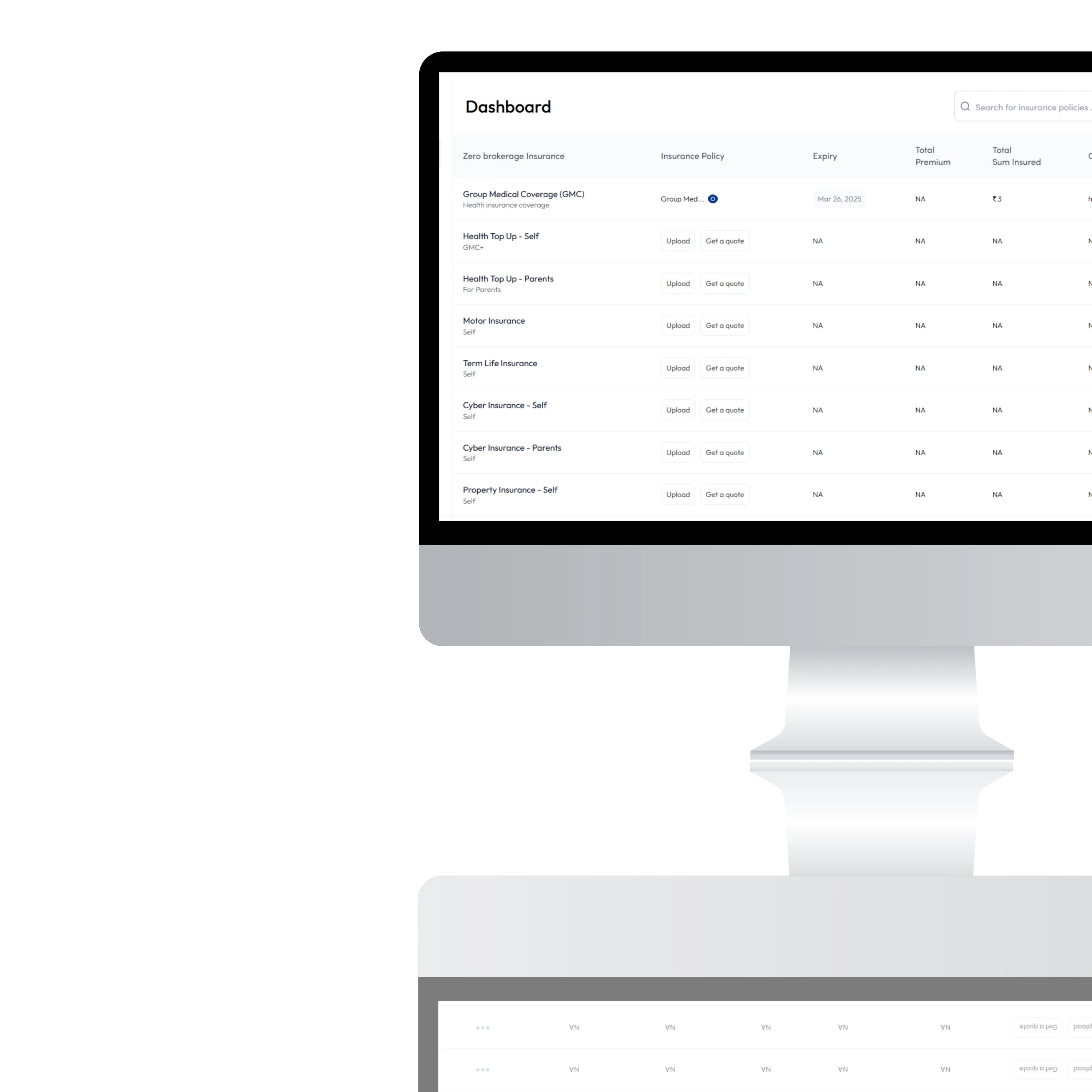

Insurance Made Easy Online

Log in to Industry Cover for top-tier insurance, treatments, and cashless claims.

Give Your Team India's Best Healthcare Experience

Full Body

Comprehensive checkups at home or in office

Vision Care

Eye care that ensures clarity and focus every day

Dental Care

Top-notch dental care for confident, healthy smiles

Mental Wellness

Mental health support for resilience and happiness

Parents Care

Health benefits for parents – because family matters